Florida Dept Of Revenue

Florida Dept. of Revenue - Florida Dept. of Revenue

Beginning October 1, 2021, Florida businesses will be required to report new hire information for independent contractors to the Florida Child Support Program. To learn more about the requirements, read section 409.2576, F.S. The Department of Revenue Child Support Program provides a variety of ways to report, including online and by mail or fax.

https://floridarevenue.com/

Florida Dept. of Revenue - Home - floridarevenue.com

The Florida Property Tax Data Portal is a service of the Florida Department of Revenue’s Property Tax Oversight (PTO) program. This portal provides all of PTO's published data reports and access to public tax roll data. Published reports include statewide and county level summary reports regarding property values, exemptions and taxes levied.

https://floridarevenue.com/dataPortal/Pages/default.aspx

Florida Dept. of Revenue - Florida Dept. of Revenue - floridarevenue.com

Beginning October 1, 2021, Florida businesses will be required to report new hire information for independent contractors to the Florida Child Support Program. To learn more about the requirements, read section 409.2576, F.S. The Department of Revenue Child Support Program provides a variety of ways to report, including online and by mail or fax.

https://qas.floridarevenue.com/Pages/default.aspx

Florida Dept. of Revenue - Home - floridarevenue.com

In Florida, local governments are responsible for administering property tax. The Department of Revenue's Property Tax Oversight p rogram provides oversight and assistance to local government officials, including property appraisers, tax collectors, and value adjustment boards. About Us.

https://qas.floridarevenue.com/property/Pages/Home.aspx

Florida Dept. of Revenue - Florida Sales and Use Tax

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Florida's general state sales tax rate is 6% with the following exceptions: 4% on amusement machine receipts, 5.5% on the lease or license of commercial real property, and 6.95% on electricity.

https://qas.floridarevenue.com/taxes/taxesfees/Pages/sales_tax.aspx

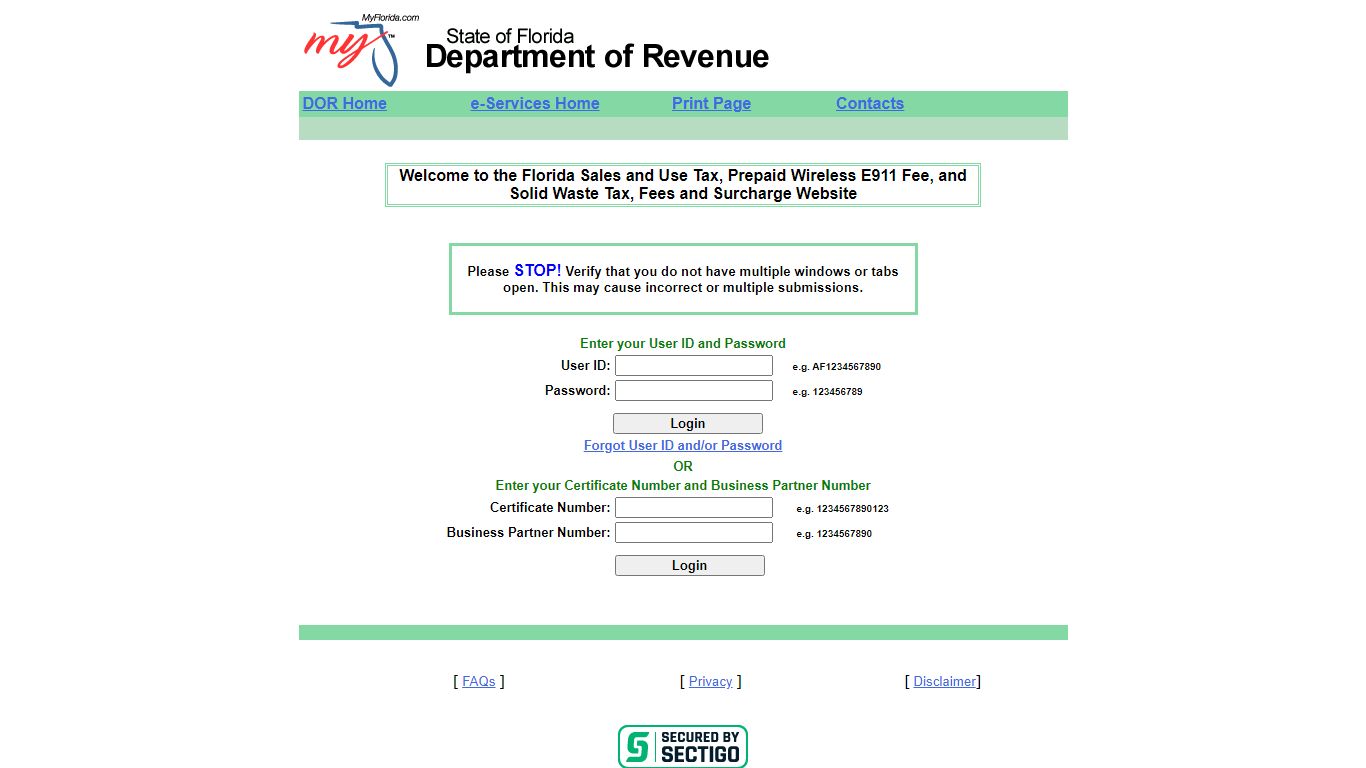

Florida Department of Revenue - Sales and Use Tax Application

Welcome to the Florida Sales and Use Tax, Prepaid Wireless E911 Fee, and Solid Waste Tax, Fees and Surcharge Website.

https://ritx-fl-sales.bswa.net/

Florida Dept. of Revenue - Florida Dept. of Revenue

Florida Department of Revenue 5050 West Tennessee Street, Tallahassee, FL 32399 ...

https://newhire.floridarevenue.com/SitePages/home.aspx

Florida Department of Revenue - floridarevenue.com

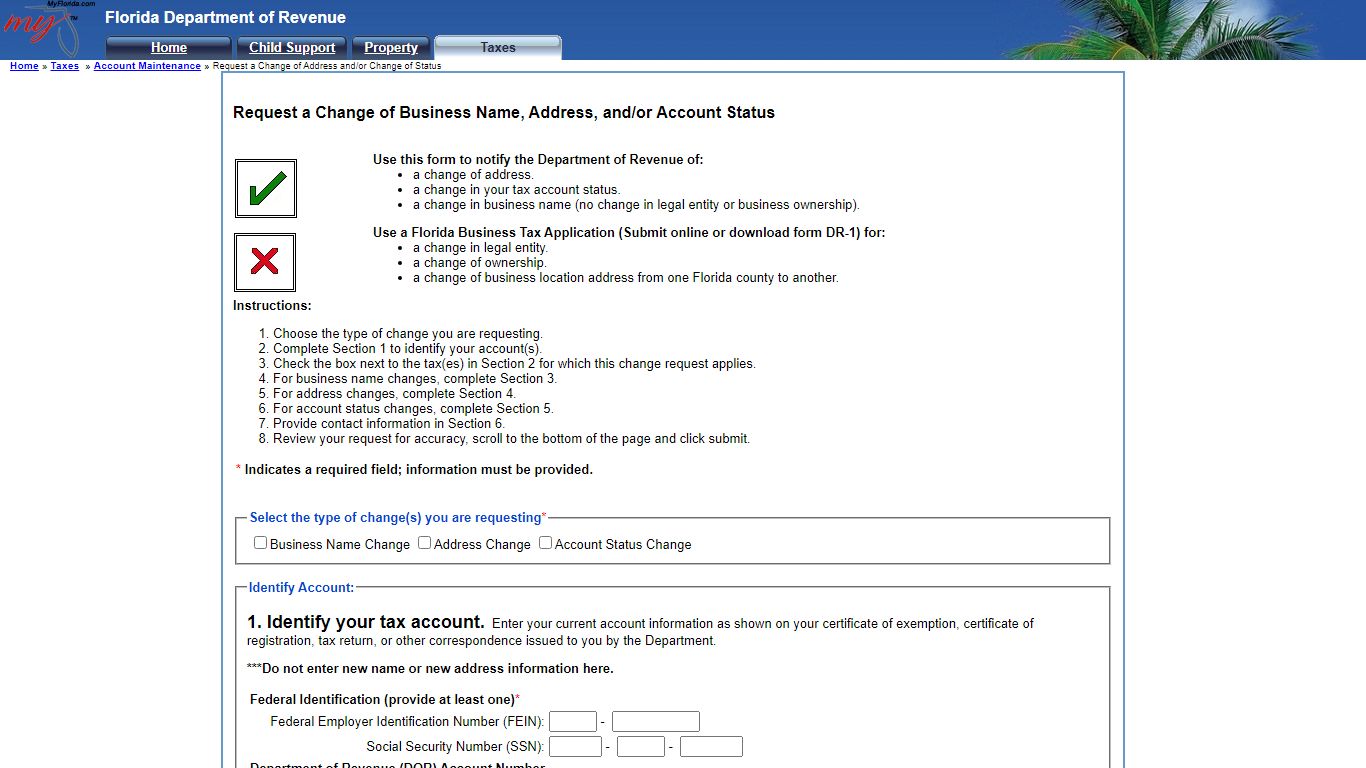

Use a Florida Business Tax Application (Submit online or download form DR-1) for: a change in legal entity. a change of ownership. a change of business location address from one Florida county to another.

https://taxapp.floridarevenue.com/taxinquiry/